Both are good, but one is BETTER than the other.....

What does a pre-qualified mortgage mean?

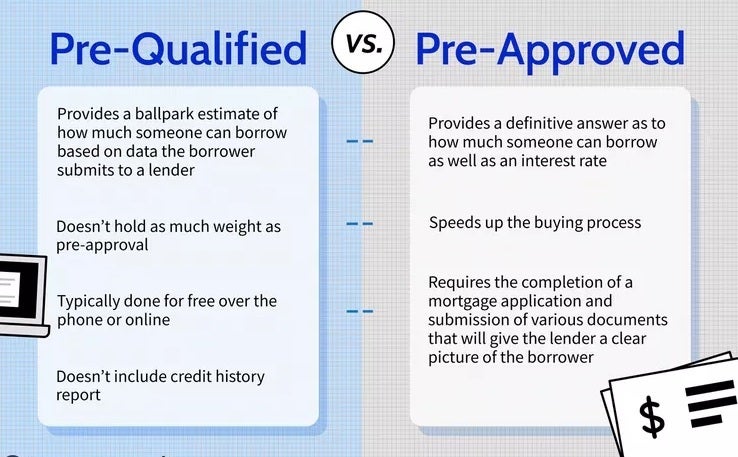

Being pre-qualified by a bank or mortgage broker simply means that you have a vague commitment from a specific mortgage lender for future funding. This is a ballpark estimate only of how much you can borrow for a mortgage, it can be done over the phone or online by a form you fill out. It does not include credit history, as well as

the biggest problem is it it does not give you a commitment for terms. IE: your rate or amount they will lend. Generally pre-qualification is not a full commitment by your lender.

What does a pre-approved mortgage mean?

Basically pre-approval is a preliminary evaluation of a borrower by a lender that can be either a bank or a mortgage broker. This will determine whether they can be given a pre-qualification commitment in writing. Pre-approvals are generated with credit checks which facilitate pre-approval analysis. Pre-approval can provide a potential borrower with a written interest rate and a maximum amount they will lend.Why are Mortgage Pre-Approvals So Important?

Pre-Approvals: Lock in your rate for 90 to 120 days. So if the rate goes up, you are guaranteed what they committed to on paper. Or if the rate goes down they will match it the current rate. Either way you win.

Multiple offers: Pre-Approval letters give you more clout for your offer to be accepted especially in a multiple offer situation! This gives you an edge over others who don't have one ready thereby increasing your odds of your offer being picked!

MOST IMPORTANTLY - Realtors and Sellers alike LOVE them! ....It's a WIN-WIN!...and you'll be happy too!

Copywrite Donna Fuller