March 2025 Stats - Tariffs, Economic Uncertainty stall Spring Market in the Fraser Valley

Posted on Apr 05, 2025 in FVREB Monthly Market Report

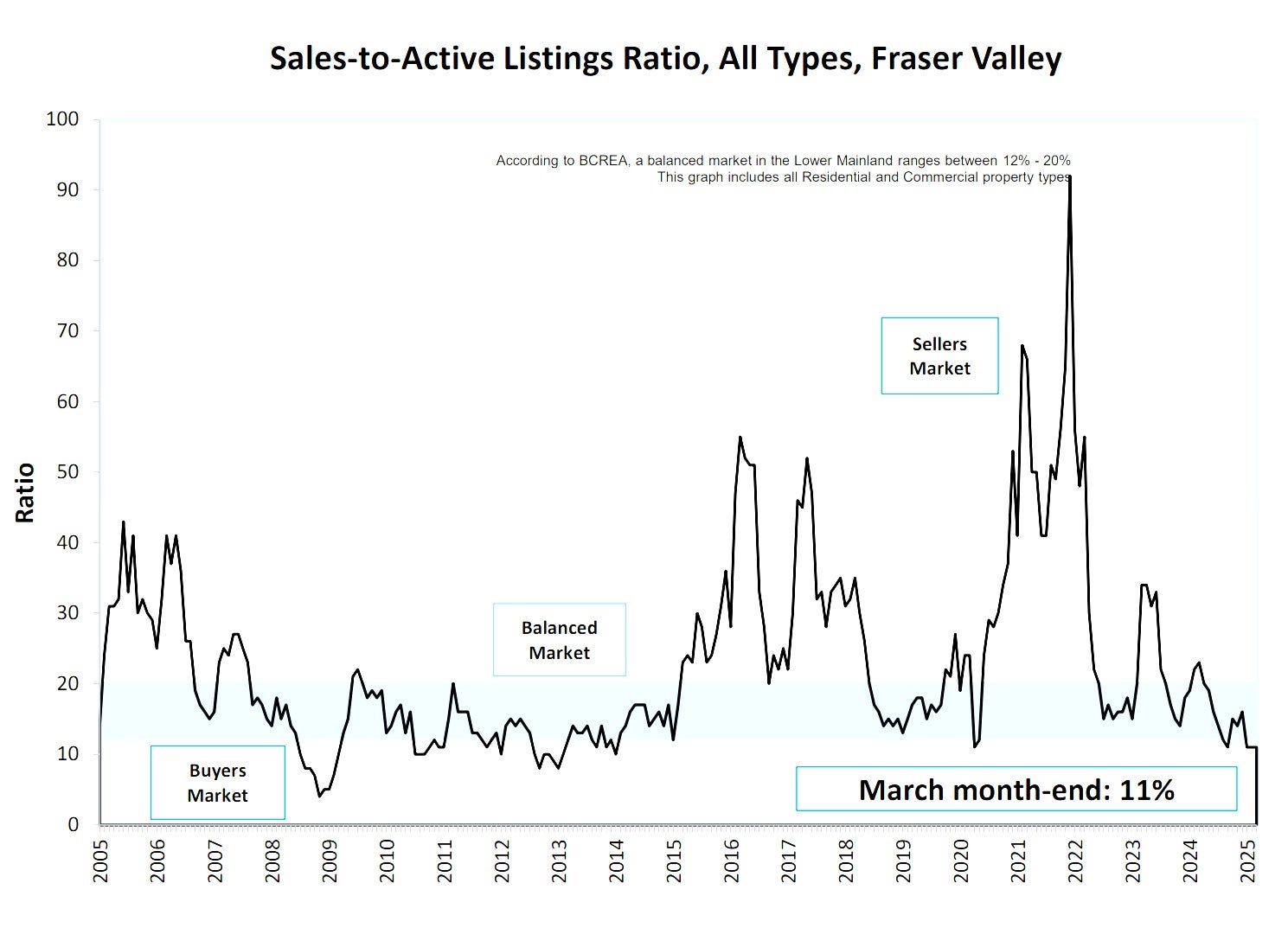

March home sales in the Fraser Valley remained nearly 50 per cent below the 10-year average — making for the slowest start to the spring market in more than 15 years.

March home sales in the Fraser Valley remained nearly 50 per cent below the 10-year average — making for the slowest start to the spring market in more than 15 years.The Fraser Valley Real Estate Board recorded 1,036 sales in March, up 13 per cent from February, but still

26 per cent below sales recorded this time last year.

Following a decline on th...

March 2025 Stats - A Market made for Buyers is missing Buyers in GVRD

Posted on Apr 05, 2025 in GVR Monthly Market Report

Home sales registered on the MLS® in the Metro Vancouver* for the month of March were the lowest going back to 2019 for the same month, while active listings continue to their upward trend.

Home sales registered on the MLS® in the Metro Vancouver* for the month of March were the lowest going back to 2019 for the same month, while active listings continue to their upward trend.The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totaled 2,091 in March 2025, a 13.4 per cent decrease from the 2,415 sales rec...

Buying Recreational Properties in BC Interior - Forecast

Posted on Mar 31, 2025 in Buyers

The recreational property market in the Central and North Okanagan regions experienced notable shifts in 2024, influenced by various economic factors. According to a report by Castanet, the national median price for single-family recreational homes declined by 4.5% year-over-year to $592,000. In contrast, condominium prices in recreational areas sa...

The recreational property market in the Central and North Okanagan regions experienced notable shifts in 2024, influenced by various economic factors. According to a report by Castanet, the national median price for single-family recreational homes declined by 4.5% year-over-year to $592,000. In contrast, condominium prices in recreational areas sa...What is the Disclosure of Representation in Trading Services (DORTS) Form?

Posted on Mar 25, 2025

The Disclosure of Representation in Trading Services (DORTS) form is a mandatory document in British Columbia real estate, designed to ensure clients fully understand their relationship with a REALTOR®.It outlines:

The Disclosure of Representation in Trading Services (DORTS) form is a mandatory document in British Columbia real estate, designed to ensure clients fully understand their relationship with a REALTOR®.It outlines:- Representation Options: Whether they are represented as a client, receive limited services as a customer, or have no representation.

- Conf...

The Bank of Canada's Interest Rate Shift: What It Means for Home Buyers and Sellers

Posted on Mar 24, 2025 in Sellers